Financial technology can make a difference in addressing the gender gap in financial inclusion. Innovative fintech services have devised genius ways to reach out to underserved consumers, including women. Here is how.

Fair and affordable access to financial services is essential for economic security and progress worldwide. Financial inclusion can improve people's employment opportunities, acquire wealth, and stimulate starting their own businesses.

With nearly 1 billion women worldwide remaining financially underserved, it’s time to act. WE Forum’s Joseph Thompson also reports that women are 21% less likely than men to own a mobile phone that helps use a financial platform, run an online business, or simply connect with friends and family.

Financial technology, or fintech, is the hope of many to boost financial inclusion and, finally, close the gender gap in financial services. Fintech, including using alternative data and credit scoring systems to generate a credit history, has enabled many individuals worldwide to access basic financial services for the first time.

Below, we will go deeper into why many (rightfully!) believe fintech can help close the gender gap in financial inclusion. We will also discuss a few examples of fintech apps that stand out in this venture.

The gender gap in financial inclusion remains evident in 2022

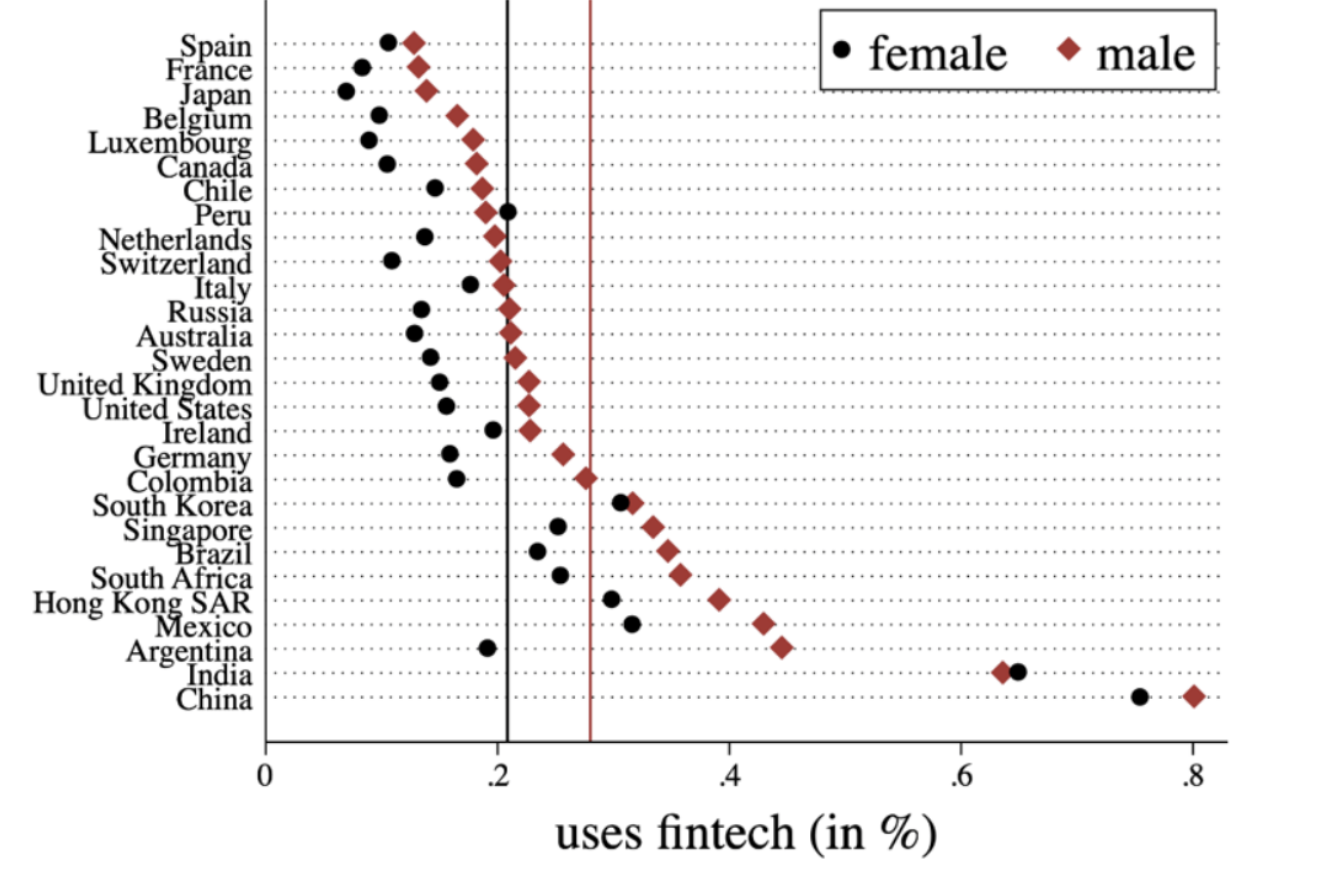

Recent findings suggest that in 2022, there is still a significant gender gap. While fintech can make a difference, much work must be done. While 29% of men use fintech, only 21% of women do the same, as reported by BIS.

The gap is evident in almost every country (as showcased in the chart below). Specific characteristics, such as age, income, education, employment, marital status, or the level of financial literacy, only show 30% of the gap.

In other words, even amongst people of similar age or income in the same country, women use fintech by around 8% less than men. These stats are just some of many that confirm a gender gap in financial services.

Source: World Bank, Chen, et al.

Women's economic empowerment (WEE) and financial inclusion are two major components of creating an equal financial system that can increase women's financial inclusion (WFI). To develop initiatives that aim to change behavior at multiple levels– starting at the household and community level– the system actors must act according to this understanding of how gender norms influence their behavior.

How governments’ missed the opportunity to include women financially during COVID-19

“When governments introduced social assistance payments in response to COVID-19, some prioritized speed over inclusion,”

says Helen Gradstein, a financial sector specialist with the World Bank Group's Finance, Competitiveness & Innovation Global Practice.

“ Numerous countries missed the chance to financially include women within their pandemic assistance programs,”

Gradstein described it as a "big missed out opportunity" during a recent event on the impact of data in driving women's financial inclusion.

By systematically promoting gender equality– like ensuring women are included in management roles, collecting accurate data, and measuring the impact of reforms– we can lower the gender gap in financial inclusion.

With more governments sending digital payments to individuals, donors, and international companies, multilateral development banks are seeking ways to ensure women have equal and secure access to financial services.

A great example is the Financial Inclusion Global Initiative. Working groups across the initiative prioritize women's financial inclusion, focusing on digital payment approval, digital identification, security, infrastructure, and trust.

A few NGOs are also evaluating the opportunities to optimize the benefits and lower the risks of blockchain and cryptocurrency. The key to achieving technology-enabled financial inclusion is to strike the right balance between taking full advantage of the benefits and minimizing the risks by investing in partnerships between central banks, global organizations, and telecom regulators.

Also, it's essential that governments and fintech companies intervene where needed to improve financial literacy, product design, and address limitations for women.

Fintech as a solution to close the gender gap in financial inclusion

Fintech can help address the barriers females face in accessing basic financial services in several ways. Smartphones have become the norm, helping reach the most remote and financially underserved individuals. These are some ways fintech can help close the gender gap in finance:

1. Less strict documentation and low charges for opening and maintaining accounts.

These are areas where most fintech innovations differentiate from traditional financial services. Lowering costs for opening accounts motivates women, especially the underserved, to open and hold accounts and perform transactions regularly.

2. Innovative fintech applications usually come with numerous services.

From deposits and withdrawals to payments for goods and services and lending, innovative fintech applications make it easier for most women who, in between working and looking after a family, may not have enough time to attend a brick-and-mortar bank.

3. The ease of using fintech services can help women better manage their time, maximizing it for more efficient (or fun!) activities.

The combination of solutions in fintech also motivates women to consider other services like savings and investments. Savings are essential for families, especially those considered susceptible and at risk of sliding into chronic hardship during financial crises or global inflation. Ouma, Odongo, and Were (2017) argue that using smartphones for financial services increases households' likelihood of saving. They further found out that the ease of saving also boosts the amount saved.

4. Easier accessibility.

Lastly, but most importantly, the ease of access and usage provided by fintech services can increase the volume of women's transactions, protecting and educating them against illegal and unfair deals and making them representatives of their financial futures.

5. Alternative credit scoring systems can be a game-changer

Among businesses using massive data for credit reports, it's not uncommon to gather data on around 1,500 variables from their customers daily.

Examples include mobile and social media usage data, images, contact lists, and GPS locations. First-time customers (credit-invisible) who lack a strong credit report can use these things as predictors of their creditworthiness.

The financial services industry must work with partners to determine how to approach opportunities and risks so alternative credit scoring can benefit women globally. Lending organizations tend to offer women smaller-sized loans and higher fines. The Social Loan Company (TSLC) and Women's World Banking are among a growing number of companies intending to address this.

With help from data.org's Inclusive Growth and Recovery Challenge, Women's World Banking aims to broaden credit accessibility for low-income female entrepreneurs.

"Women have high repayment rates relative to men, so with the right policies in place, they may in fact get bigger loans, or institutions could take more risks with women borrowers in their portfolios,” said Sonja Kelly, Director of Research & Advocacy, Women’s World Banking.

Innovative fintech apps that are helping close the gap

As fintech innovations become more advanced, accessible, and easier to use, the impact they can have on closing the gender gap is becoming bigger yearly. Evidence from mobile payment technologies confirms the impact fintech can have in bridging the gender gap in financial inclusion.

A clear example is CASHe, a leading financial wellness app in India. The app serves over 350,000 active women users, with total app downloads surpassing 20 million, and has recently become the first to offer a lending service through WhatsApp. The platform has redefined how a credit score is generated by tapping into reliable alternative data sources to underwrite and offer quick loans– through a few taps on a smartphone.

Source: CASHe app

CASHe not just helps reduce the typical banking hassles of paperwork and private meetings when distributing funds but also removes most human interactions.

Meanwhile, in Bangladesh, e-Rin is revolutionizing the digital lending space, and its launch has noted a massive change in the consumer credit environment, including women. The lending app, a joint venture between Dhaka Bank and CASHe Alliance, offers affordable and quick personal credit to salaried millennials and Gen Z-ers in the country. The app caters to the daily needs of the underserved, mainstream middle-income customers in Bangladesh that traditional banks and credit-scoring systems overlook.

The digital lending app has already achieved a 40% growth in Monthly Active Users (MAU), proving to be a breakthrough in the efforts toward the financial inclusion of 200 million Bangladeshi citizens. Using TSLC’s AI/ML-powered alternative credit scoring system, the platform can confirm a BNPL or loan approval in minutes.

Rather than income or jobs-related impact, such products that address financial exclusion at a deeper level can affect women’s financial habits and state of mind as it puts several options into their hands. This, in turn, stimulates female users to increase their savings and investments, save-now-buy-later (SNBL) perception, and their potential customers in the workforce.

New rising fintech innovations like M-Pesa, CASHe, or e-Rin can close the gender gap in financial inclusion in Asia, Africa, and the world.

Conclusion: How TSLC’s technology is contributing to closing the gender gap in financial inclusion

Fintech solutions have already started dealing with numerous barriers to financial inclusion. While the most recent Findex data highlights numerous favorable advancements, there is still a long way to go.

Further progress will depend on various aspects such as education, internet connection, smartphone usage rates, digital IDs, policy, and the advancement of female-oriented solutions. It is not just improvements in data, artificial intelligence (AI), and machine learning (ML) driving disruption in women's financial inclusion but also changes in regulations, smartphone usage, and social standards.

The Social Loan Company is aware that financial inclusion represents an improved availability of funds and promotes the principle of savings amongst low-income citizens. Thus, we are on a mission to revolutionize how money is distributed to cater to the financial needs of individuals– including women– that traditional financial and lending institutions have previously overlooked.

In doing so, TSLC aims to help unlock the full potential and the economic advantages of millions of credit-short, new-to-credit, credit-invisible customers. We deploy a global proprietary AI/ML-based alternative credit scoring system through banking and non-banking partners to fulfill our consumer-focused approach.

The credit decisioning engine operates through a unique Social Loan Quotient (SLQ) mechanism that considers 100+ macro and 2,500+ micro data points from every user. We also provide the right market for the product. At the same time, our partners handle the infrastructure, regulation, and funding, forming a win-win partnership between traditional banks and us as a fintech.

Recently, TSLC’s Global CMO, Shagorika Heryani, was awarded “Top 10 Indian Women Leaders UAE” for disrupting work towards inclusivity in the country and beyond. Speaking of the company’s goals towards the cause, she said:

“By using fintech for good, we aim to transform the credit decision market and create a one-stop platform for everyone, including women, to access financial services through simple and swift applications.

TSLC Team

TSLC Team