In 2022, financial exclusion remains a significant challenge. These 14 astounding statistics on the financial exclusion of MENAT millennials confirm the journey toward financial inclusion is far from the end.

Over the last few years, "financial exclusion" has stepped boldly into the world's vocabulary. Worldwide, organizations and countries are brainstorming on tackling this legacy struggle and building a culture of financial inclusion.

However, fewer people are aware of financial exclusion with all the discussion on financial inclusion. Many people don’t have access to essential financial products and services today: they struggle to get affordable credit or helpful financial advice and face challenges in meeting their essential financial needs.

Financial exclusion negatively affects the lives of over 1.7 billion people worldwide; it increases the costs they pay for essential services, makes them vulnerable to illegal or high-cost financial services, and (unsurprisingly) reinforces social exclusion. This has been happening within the MENAT region in the last few years (to say the least), with millennials getting the hardest hit.

And since financial exclusion is a challenge that can be destructive if left unattended, my team at TSLC and I chose to determine what financial exclusion is and underscore its impact explicitly.

What is financial exclusion?

The term ‘financial exclusion’ tends to take different forms in different communities.

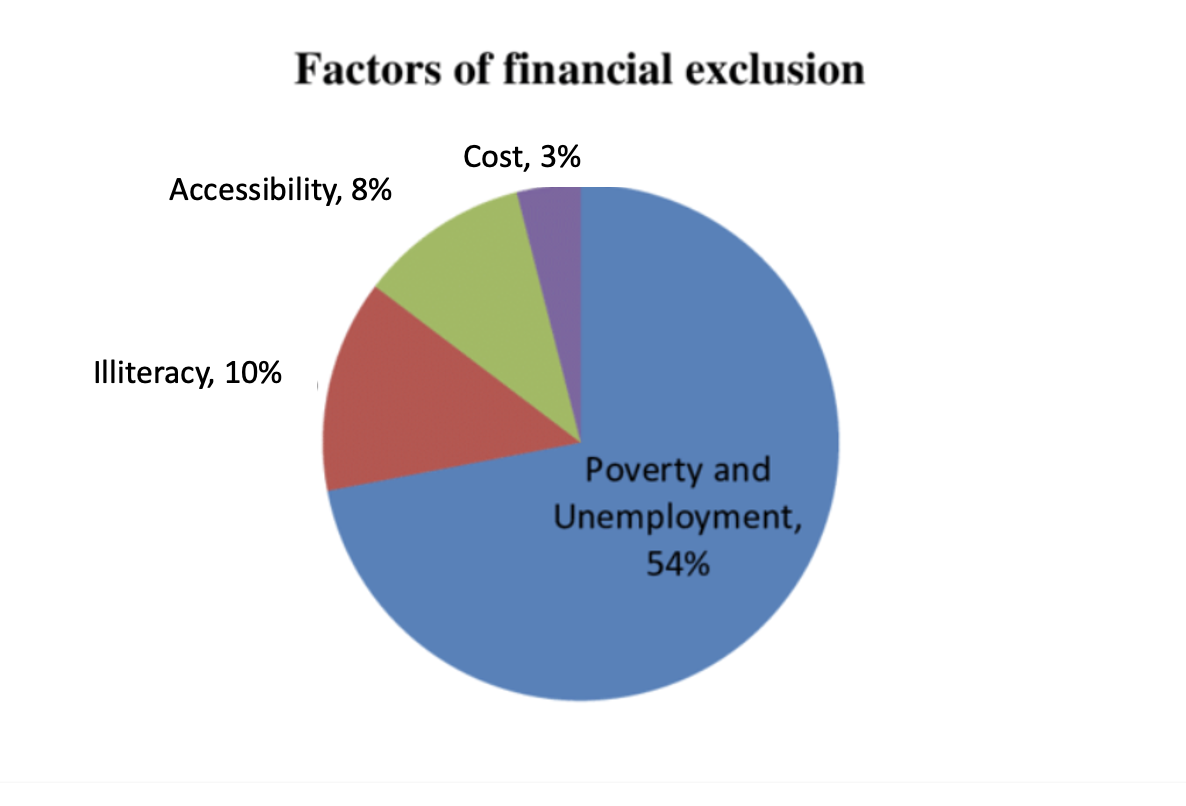

However, most often is defined as a broad concept describing a lack of access to and usage of various financial products and services. As can be seen in the image below, reasons for exclusion are more than one.

Source: ResearchGate

Financial exclusion is a state where not everyone can access needed financial products or services to manage their finances effectively. Financially excluded individuals are generally defined by one or more of the following traits:

- A lack of access to credit or other essential financial products or services.

- The usage of alternative forms of credit like doorstep lenders and pawnbrokers.

- A lack of other essential financial products such as insurance coverage, savings, and pensions.

Also, because they don’t have access to standard financial services, these individuals tend to pay more to manage their finances, face challenges in paving the way for the future, and are likely to become over-indebted.

Recently we performed a research study involving 500+ millennials based in the MENAT region– the results didn’t fail to awe.

14 key facts on the financial exclusion of MENAT millennials

Financial exclusion is an evident phenomenon in the MENAT region. Below, I will discuss 14 astounding statistics about the financial struggles of MENAT millennials. I will also discuss how my team and I tackle the challenges we know well.

46% of MENAT millennials say they are comfortable taking a loan up to 20% of their yearly income.

Nearly half of the millennials we surveyed said they are comfortable with taking a loan of up to 20% of their annual income.

Getting a loan from friends and family is no longer the best option for many, and among the reasons for not doing so is the risk of damaging a relationship with the closest people. That’s where transparent digital lending services come in. For example, apps like CASHe in India or eRin in Bangladesh offer great options for social lending.

15% of people living in MENAT say children's education is the primary motive for taking a loan.

15% of people living in MENAT claim to take a loan to finance their children’s education, while less than 1/4 use it for educating themselves.

Education is a powerful way to tackle poverty, develop future potential, and close social inequality gaps. Regarding earnings, education can increase the hiring rate and income potential by 10%, Unicef reports.

71% of MENAT millennials have been turned down when applying for a personal loan at least once in their lifetime.

Most millennials in the MENAT region have conditional access to credit, meaning they have access but need to fulfill a long list of criteria of the legacy system to get approved.

The most common reasons for being turned down for a personal loan include a thin or invisible credit score, a high debt-to-income ratio, unstable employment history, too low income for the desired loan amount, or missing important information or paperwork within the application.

My team and I are on a mission to revolutionize money and remove barriers to affordable credit. TSLC’s alternative credit scoring technology focuses on the future potential of a consumer rather than traditional credit history.

52% of MENAT millennials are yet to apply for their first personal loan due to fear of being turned down.

Lack of job security and trustworthiness in traditional financial institutions include the fears that make MENAT millennials avoid applying for a personal loan.

Using industry-leading Al/ML-driven tech, we aim to democratize credit by bringing a paradigm shift in financial access, enabling cost efficiencies, transparency, and speed.

Nearly 23% of people in MENAT get personal loans to support their families.

Supporting their family tops the list of reasons why 2 out of 10 MENAT individuals get a personal loan. Family support often takes the form of celebratory events, urgencies, and education for kids. In most cases, this represents individuals living and working outside the country and sending money back home.

Nearly 19% of MENAT seek out personal loans for celebratory purposes like getting engaged or married.

Celebratory events are one of the top reasons why MENAT individuals apply for a personal loan. Expenses to getting engaged, and even more for marriage, are often unbearable, leaving individuals with a single choice– a personal loan.

But how possible is this in MENAT? The nature of legacy banking has made it nearly impossible for certain parts of society to get a loan. This is where TSLC’s technology and partners come in.

Through a unique AI/ML-powered credit enablement platform, TSLC enables its subsidiaries and partners to approve credit by evaluating consumers through their social data and smartphone behavior instead of the traditional credit scoring system.

16% of digital natives in MENAT plan to take a loan within the next three months.

MENAT digital natives, especially millennials, have proved to be curious and eager to thrive and make a change—16% plan to boost their objectives by taking personal loans. Thus, easy and affordable access to credit is essential to support their dreams.

6% of millennials in the MENAT region aim to get a personal loan to pay for a medical procedure or emergency.

Medical procedures and emergencies are a reality of life that often come at an unpredictable time. This happens to 6% of MENAT millennials who admit to taking a personal loan due to life’s unexpected events.

TSLC’s revolutionary alternative credit scoring system aims to serve the previously overlooked individuals, providing access to credit when they need it most.

Over 6% of young generations in MENAT are exempt from applying for a personal loan because they don’t have a credit history or credit score.

TSLC aims to revolutionize money and cater to the financial needs of individuals that the legacy financial system rejects. In doing so, TSLC helps unravel the financial potential and economic advantages to millions of credit-thin, new-to-credit, and credit-invisible customers.

Nearly 17% of Gen-Y in MENAT claim they’re staying away from getting a personal loan due to the process being “too complicated.”

Taking a loan is “too complicated” for most people, making 16.7% of MENAT Gen-Yers unwilling to apply for one. Lack of financial literacy, long processes, and numerous bureaucratic requirements top the reasons. With TSLC’s transformative technology, this has changed.

TSLC’s subsidiaries, CASHe and eRin (In India and Bangladesh, respectively), offer user-friendly platforms that ease the credit approval process, requiring less than a few clicks and no more than 20mins of time.

32% of MENAT millennials are “extremely likely” to embrace a social data-based instant lending app.

The old-school legacy system of credit scoring has left many on the sidelines. Credit-thin and credit-invisible individuals have meager chances of getting access to credit.

Powered by artificial intelligence (AI) and machine learning (ML), our alternative credit scoring system collects behavioral and social usage data. This allows our subsidiaries and partners to evaluate future potential rather than merely past credit history.

50% of MENAT millennials are exploring apps that provide alternatives to traditional bank lending.

Modern digital lending apps are the norm of lending services, replacing the old-fashioned lending processes. These apps tend to be faster and more low-cost.

Take CASHe in India as an example. With a matter of few taps, customers can get credit when they need it. Recently CASHe also launched a WhatsApp lending service as instant access to credit for their consumers in India.

12% of young parents in MENAT claim saving money for their children’s education is a top priority.

Being a young parent, as fun and exciting as it is, also comes with plenty of responsibility. When it comes to the MENAT region, a worthy percentage of young parents prioritize saving money for their children’s education above other things.

Fearing a turndown or a lengthy and exhaustive lending application, they tend to feel let down by legacy financial institutions.

1/4 of millennials living in MENAT feel comfortable taking a loan of up to 50% of their yearly income.

MENAT millennials are ready to get a personal loan of up to half their annual income. The reasons for a loan, most of which we already mentioned above, include starting a business, thus contributing to society for good.

Through affordable credit scores through our disruptive source, lending, and distribution platform, TSLC promotes and encourages the financial inclusion of the underbanked.

Bottom line: How TSLC’s technology is contributing to alleviating financial exclusion

Financial exclusion is a challenge that millions of people face daily. In the lack of financial resources, low-income individuals struggle to progress toward living a healthier, more sustainable life.

At the core of TSLC's mission is decreasing financial exclusion by providing previously-unavailable opportunities for underserved individuals. We work to help communities and small businesses that are overlooked by the legacy financial sector.

Through a ground-breaking AI/ML-driven alternative credit scoring system and industry-leading banking and non-banking partners, we aim to make credit more accessible and affordable for digital natives.

The potential we aim to unlock includes offering credit to credit-thin and credit-invisible individuals. We do this by partnering with banking industry leaders and using alternative credit scoring and analytics to focus on future potential rather than the traditional credit history. We take pride in seeing our partners and customers use our unique alternative credit scoring system to catalyze their own financial growth.

After over seven years of working to serve underserved digital natives in frontier and emerging markets, we can claim confidently that access to essential financial resources such as credit can alleviate financial hardships, strengthen communities and change lives.

Deepak H Saluja

Deepak H Saluja